-

Recent Posts

Blogroll

Sites

Tag Cloud

america apple art auto bailout ayn rand bailout barack obama bonuses bubble Business citigroup congress consumerism consumption corporate culture corruption culture deficit democrats economics economy education entrepreneurs Environment equality facebook financial crisis financial meltdown food free market gitmo goldman sachs google GOP greed health care health care reform income inequality insurance internet john boehner john mccain libertarian lobbyists marketing McCain morals movies music Obama Philosophy photography politicians Politics Pop culture regulation Religion republicans richard posner sacrifice san francisco Sarah Palin silicon valley supreme court taxes tea party tech bubble Technology Ted Stevens terrorism Trends unions venture capital wall street wealthThoughtbasket\’s RSS feed

-

Join 75 other subscribers

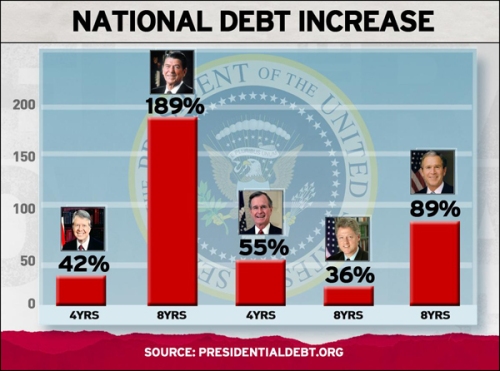

Increase in National Debt by President

This entry was posted in Business, Politics and tagged deficit, economics, national debt, politicians, Politics, taxes. Bookmark the permalink.

You must be kidding. Try this:

http://wp.me/pMW8w-2Q

And this:

http://wp.me/pMW8w-si

Top Tax Rates were 70%+ from 1936 to 1980, and 90%+ from 1944 to 1963.

Since 1981, the Reagan Top rate tax cuts from 70% to now 35% have cost us 300 billion per year, 9 trillion over 30 years, plus 7 trillion for interest on the Republican Debt.

The higher top tax rates also had deductions, but those deductions were for plants, wages and equipment. Those deductions created good paying jobs.

Why we must raise taxes on the rich – taxes for the middle class have soared as taxes on the rich have plummeted.

http://www.skyvalleychronicle.com/FEATURE-NEWS/WHY-WE-MUST-RAISE-TAXES-ON-THE-RICH-br-Taxes-for-middle-class-have-soared-taxes-for-the-rich-have-plummeted-635614

Growth in GDP vs Top Marginal Tax Rate vs Debt vs Government GDP

Historical Facts Debunking Republican LIES.

As you can see, the Higher top Marginal Tax Rates of the Past did not deter growth, they did not grow government, but they did keep the debt down.

The biggest reason we are 15 trillion in debt is due to the top rate tax cuts.

Learn from History.

Successful Economics is about balanced regulation, progressive tax rates, as well as government spending on social programs and infrastructure.

1947 – 1979 We All Grew

1980 – 2007 We Grew Apart

Growth of Family Income

If the average American family still got the same share of income they earned in 1980, they would have an astounding $13,000 more in their pockets a year. It’s worth pausing to consider what our economy would be like today if middle-class consumers had that additional income to spend.

http://www.businessweek.com/news/2011-12-07/raise-taxes-on-rich-to-reward-true-job-creators-nick-hanauer.html