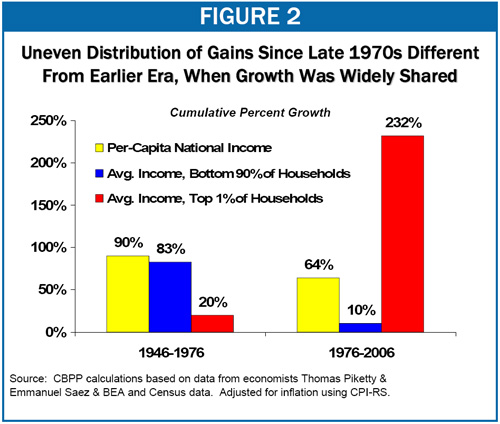

A key Republican talking point is that the wealthy are “job creators” and that any tax on these job creators will cause them to fold their cards and go home, hurting the economy in the process. This is clearly ridiculous, and I have challenged before the concept that tax rates diminish incentives to build companies, but here is a great essay from an entrepreneur and investor (a successful one — he is clearly in the 1%) describing how people don’t create jobs, the economy does. And the economy is made up of regular folks — the 99% — who need to buy the products produced by the entrepreneurs. Without a successful consumer class, nobody will be a job creator.

-

Recent Posts

Blogroll

Sites

Tag Cloud

america apple art auto bailout ayn rand bailout barack obama bonuses bubble Business citigroup congress consumerism consumption corporate culture corruption culture deficit democrats economics economy education entrepreneurs Environment equality facebook financial crisis financial meltdown food free market gitmo goldman sachs google GOP greed health care health care reform income inequality insurance internet john boehner john mccain libertarian lobbyists marketing McCain morals movies music Obama Philosophy photography politicians Politics Pop culture regulation Religion republicans richard posner sacrifice san francisco Sarah Palin silicon valley supreme court taxes tea party tech bubble Technology Ted Stevens terrorism Trends unions venture capital wall street wealthThoughtbasket\’s RSS feed

-

Join 75 other subscribers